philadelphia property tax rate 2019

Philadelphia Makes Progress on Collecting Delinquent Property Taxes Noncollection rate dropped from 65 to 39 percent in five years outpacing other high-poverty cities improvement Article February 4 2019 By. Philadelphia property tax rate 2019.

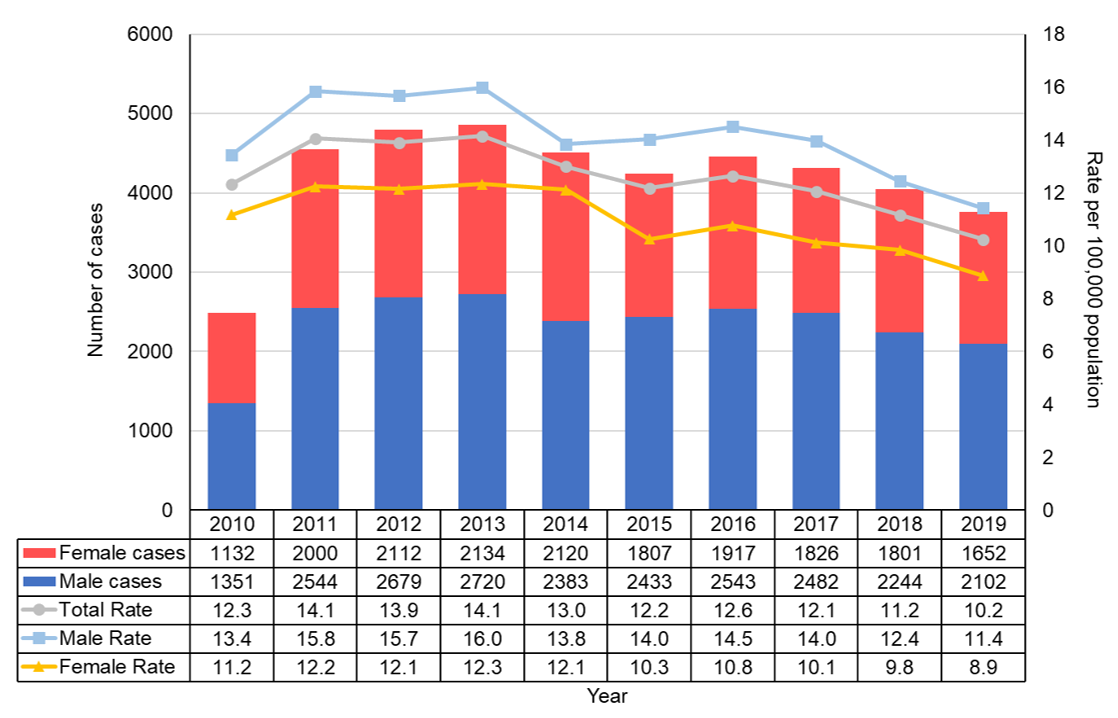

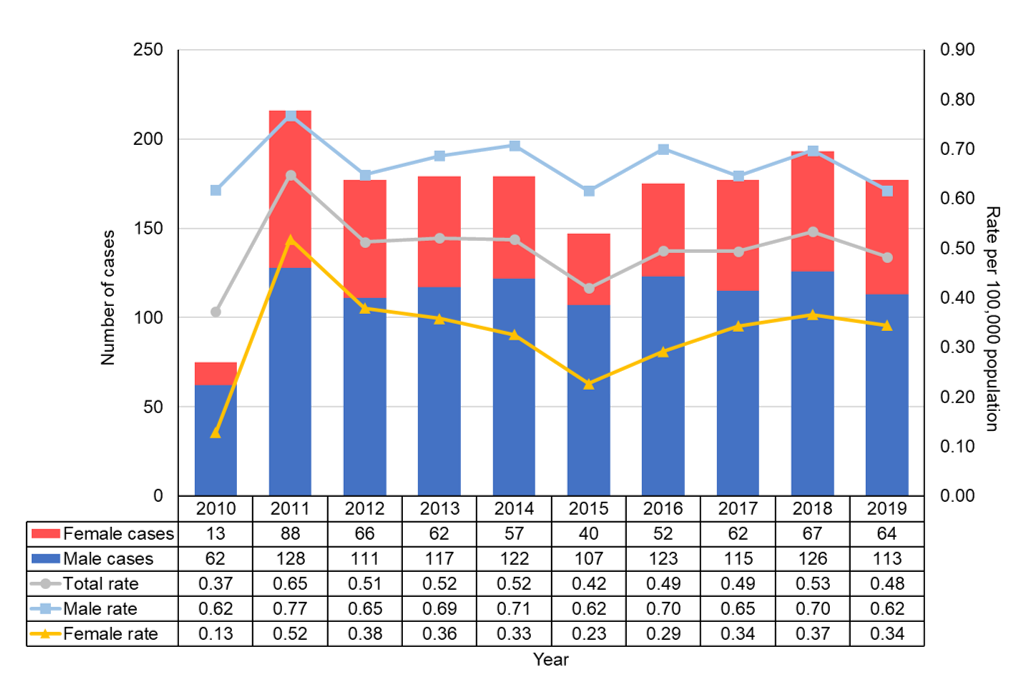

Report On Hepatitis B And C Surveillance In Canada 2019 Canada Ca

Philadelphia property tax rate 2019.

. The City of Brotherly Loves rate of 11 places it. A philadelphia wage tax refund petition and you must plete a city of philadelphia form 83 a272a wage tax refund petition wage tax refund petition refunds city philadelphia 2018 2018 philadelphia wage tax refund petition 83 a272a 83 a272a Wage Tax Refund Petition Salary. The city of Philadelphia assesses property at its current market value which is.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. People in philadelphia county pa have an average commute time of 325 minutes and they drove alone to work. 2018 Philadelphia Wage Tax Refund Petition 83 A272a.

How Are Our Schools Funded Reclaim Philadelphia So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new property assessments for 2019. The rental of property in most cases is considered the operation of a business. 1 days ago The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Collection rates for real estate taxes are at an all-time high with on-time payments at 961 percent and a 397 percent reduction in overall delinquent tax. April 20 2022 mens short sleeve wallpaper black short sleeve henley mens Our Black Short Sleeve Henley is a straight up stunner. The NPT tax rate for 2019 is 38712 of net income for residents or 34481 for non-residents.

The Kenney administration said those changes which resulted in hefty tax hikes for many reflected the real estate market. The City of Philadelphias tax rate schedule since 1952. 2019 Philadelphia City Wage Tax Rate.

How Are Our Schools Funded Reclaim Philadelphia. April 15 and June 15 of each tax year. That increased by an additional 31 for the last reassessment which was completed in 2019 and used for 2020 and 2021 tax bills.

Tax bills for nearly half the blocks homeowners will jump from around 1000 to close to. Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. Posted on January 20 2021 by.

Oct 11 2019 Philadelphia performs well for commercial property tax rates compared to other cities in the nation according to a recent report. Residential Property Taxes Likely By the end of this year Philadelphia City Council with the approval of Mayor Jim Kenney will likely pass. An Experimental Evaluation of Nudge Strategies Philadelphia leads largest cities in property tax breaks This map makes it easy topare your property tax change to your neighbors Your 2020 property tax bill is now delinquent Philadelphias ranking for property tax rate.

Philadelphia property tax rate 2019. Examine our database of Philadelphia 2019 Property Assessments. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT.

135 of home value Tax amount varies by county The median property tax in Pennsylvania is 222300 per year for a home worth the median value of 16470000. According to a more exact calculation the countys average effective property tax rate is 099 percent compared to the states average effective property tax rate of 150 percent. It will increase by an.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA. Counties in Pennsylvania collect an average of 135 of a propertys. Tax rate for nonresidents who work in Philadelphia.

Corporations are exempt from the Net Profits Tax. How much is the tax. So residents were shocked last week to learn that the 51 homes on the 2500 block of South Mildred nearly doubled in value overnight on paper as the city rolled out new property assessments for 2019.

Deterring Property Tax Delinquency in Philadelphia. Heres how to calculate your new tax bill. Philadelphia property tax rate 2019.

Between 2018 and 2019 the median property value increased from 167700 to 183200 a 924 increase. The tax bill is issued on the first day of the year and payment is due beforeon March 31. The rate as of July 1 2019 for residents of Philadelphia decreases from 38809 to 38712 and the rate for nonresidents of Philadelphia decreases from 34567 to 34481.

2019 property rate tax philadelphia property tax rate 2019 091 of home value. Larry Eichel Thomas Ginsberg Read time. Alternatively the office found removing specifically the school district portion of the tax abatement in that.

Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax. The Office of Property Assessment OPA will establish the value of the property and from there you will be responsible for 13988 of the assessed value. The OPA assess properties based on their size age location and use home or business.

Tax rate schedule PDF. It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation. What makes Philly unique among its tax-happy peers is that nearly 50 percent of the citys revenue comes from wage taxes currently levied at a rate of around 39 percent while only 20 percent.

Do you have any tips or suggestions. When is the tax due. City Council seeks to nix a proposed 41 percent increase in the citys property tax rate a measure that has been urged by Mayor Jim Kenney to close the 630 million budget deficit of.

The City of Philadelphia wage tax is a tax on salaries wages commissions and other compensation paid to an employee who is employed by or renders services to an employer.

Trends In The Valuation Of Agents And Brokers 2019 Expert Commentary Irmi Com

Sebastian Cossa 33 Autographed 2019 20 Edmonton Oil Kings Game Worn Red Jersey Nhl Auctions

Report On Hepatitis B And C Surveillance In Canada 2019 Canada Ca

The 10 Most Affordable States In America States In America Map Best Places To Retire

America S Formerly Redlined Neighborhoods Have Changed And So Must Solutions To Rectify Them

Report On Hepatitis B And C Surveillance In Canada 2019 Canada Ca

United States Ev Ebitda Construction 2021 Statista

For A Roof In Old Westbury N Y A Singular Slate From England Published 2019 Old Westbury Westbury Roof Restoration

Several Tax Changes In 2019 To Affect Buy To Let Property Entrepreneur Academy Choosing A Career Career Path

U S Homeownership In The 2010s A Decade Of Rising Prices Propertyshark

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Philly S Finances Are On The Mend As City Passes 2020 Budget Philadelphia 3 0

U S Foreclosure Activity In October 2019 Climbs Upward From Previous Month Attom

Get The Right Mortgage With Florida S Largest Mortgage Lenders Mortgageflorida Tk Lowest Mortgage Rates Mortgage Rates Mortgage Lenders

The Richest Person In Each State 2019

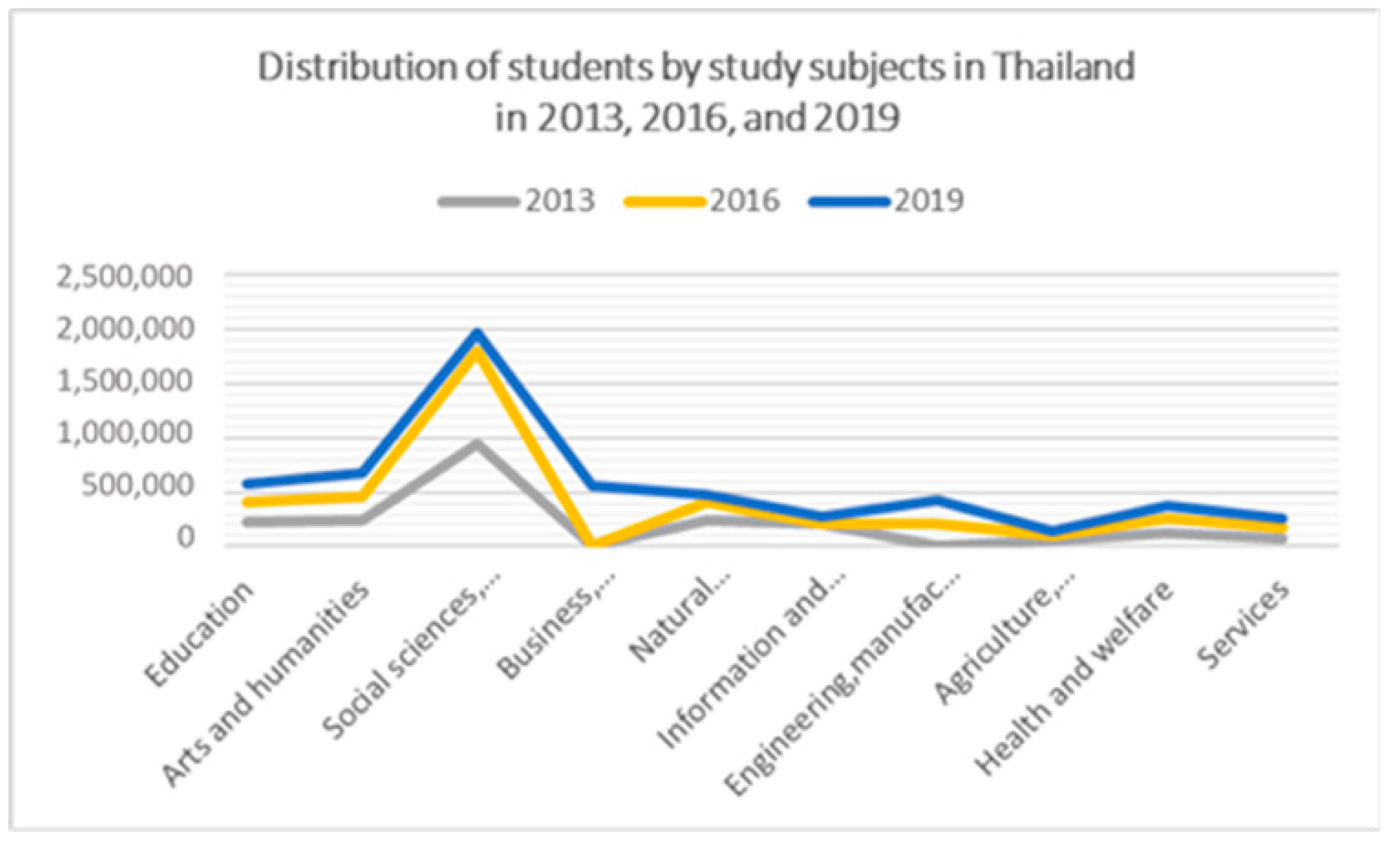

Sustainability Free Full Text Success Or Failure Of The Thai Higher Education Development Critical Factors In The Policy Process Of Quality Assurance Html

Philadelphia County Pa Property Tax Assessor Data Attom

Default Transition And Recovery 2019 Annual Global Corporate Default And Rating Transition Study S P Global Ratings

March Madness 2019 Real Estate Edition March Madness College Basketball Teams Real Estate